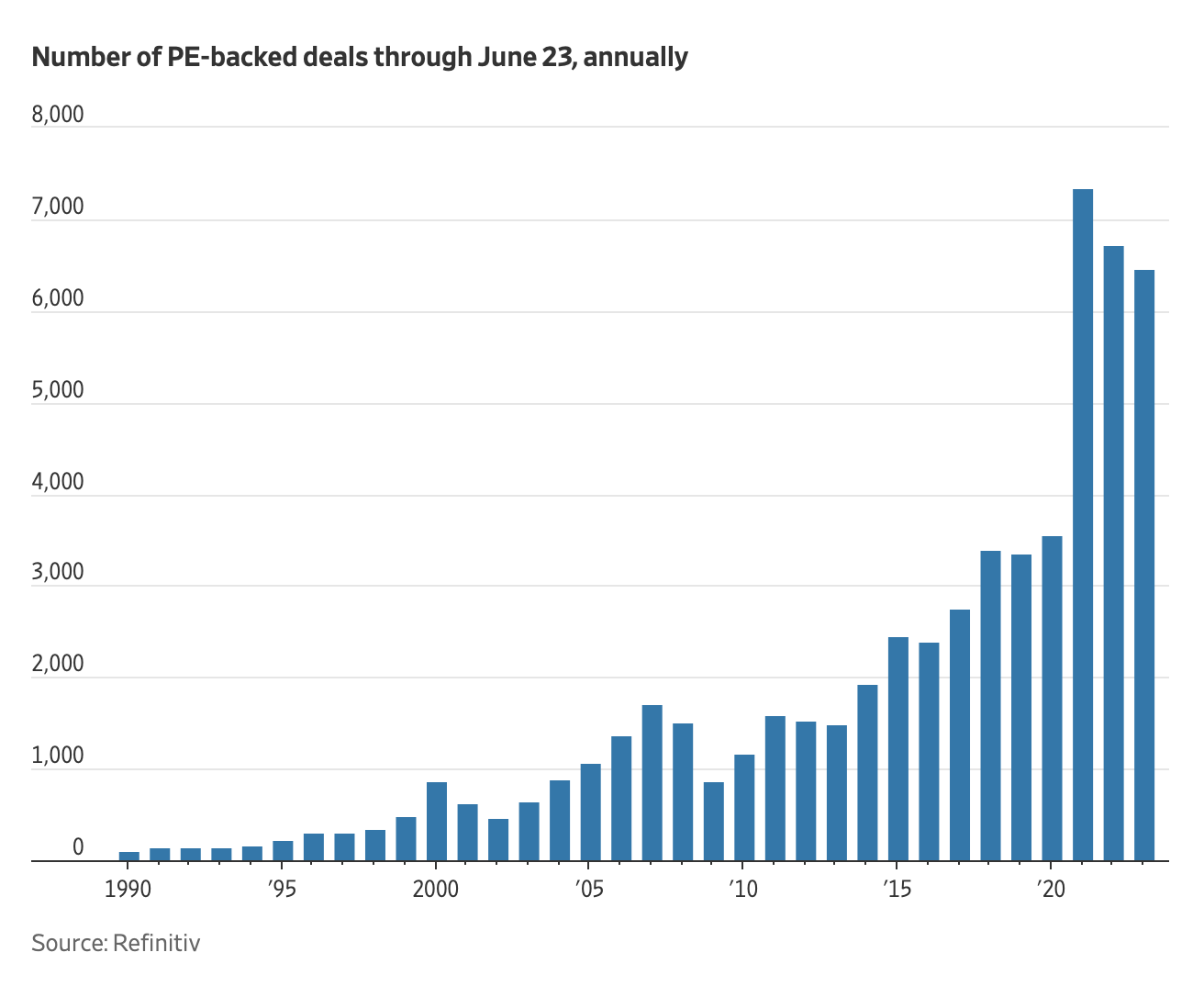

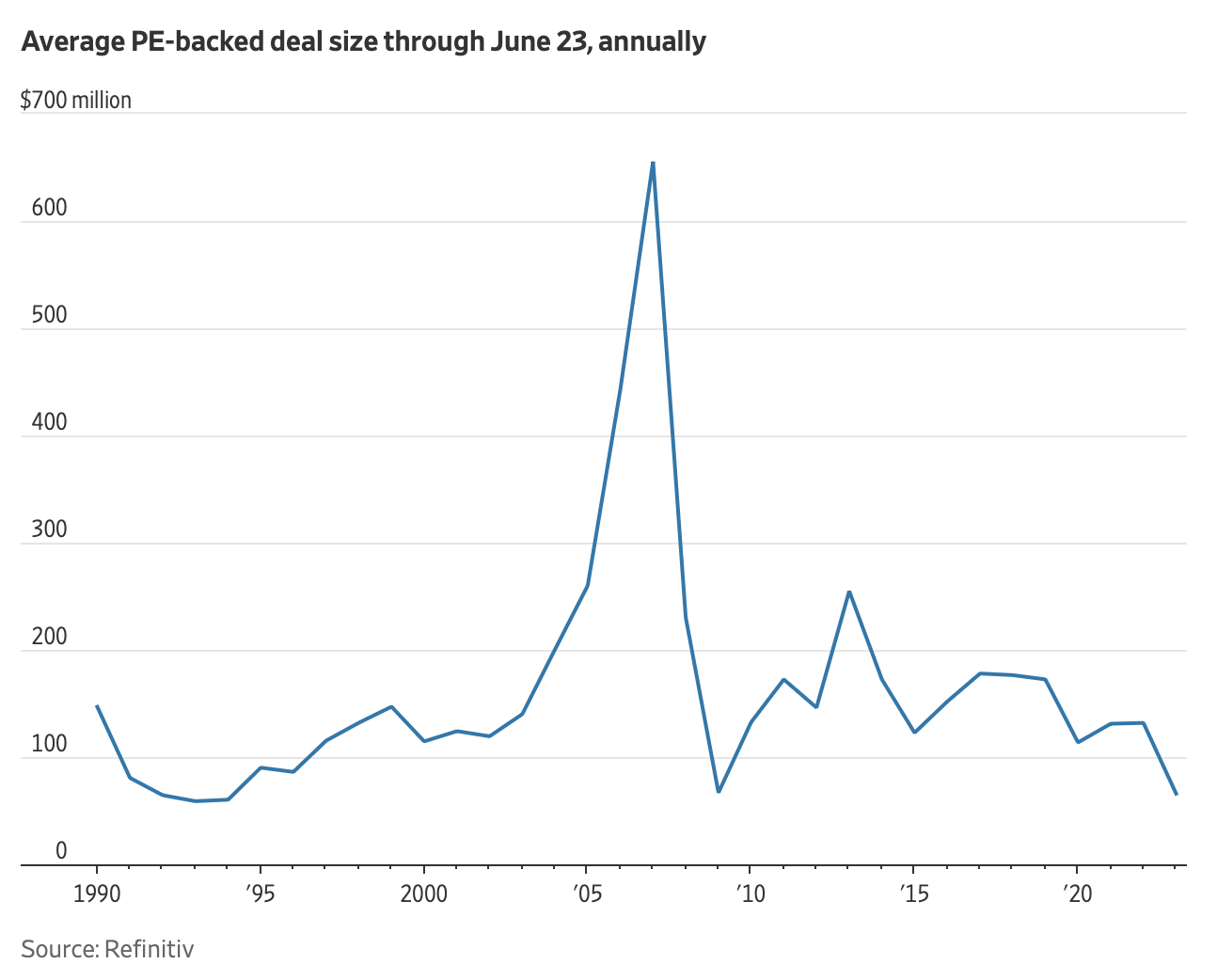

In the first half of 2023, PE transactions were down more than 50% from the prior year, according to an article in the Wall Street Journal.

And that’s great news for many business owners looking to retire.

Private equity (PE) buyers are a prominent force in global mergers and acquisitions. So, it’s no surprise they play a significant role in many private company transactions. In fact, for some business owners, selling to a private equity firm is the ideal way to cash in on years of hard work and secure the company’s future success.

But this year, the markets are volatile, the economy is wavering, and interest rates are considerably higher. Those factors have all contributed to a considerable drop in PE-backed transactions.

The rise in interest rates, in particular, has made it more difficult and more expensive to obtain debt for larger transactions that are the typical bread and butter for most PE firms. But PE firms still have more than a trillion in capital to spend, and they need to invest it to start generating returns.

As a result, many PE firms are coming down-market, looking for smaller transactions that fit with their existing portfolios and can be done with little or no debt. And that’s where it gets really interesting because the mixed economy and the threat of a recession mean fewer good companies are for sale. So, there are more buyers chasing fewer good sellers, and that’s great news for business owners looking to sell and retire.

Businesses with growing sales and predictable profits are always in high demand, but that’s especially true this year.

If you’re a business owner waiting for the right time to sell, this might be it. If that is the case, or if a PE firm has approached you, we’d love to talk to you about how we engage multiple buyers so you can choose the ideal successor while maximizing your company’s value.

Please contact us for a quick, confidential conversation that doesn’t obligate you to anything and doesn’t cost you anything but could increase your company’s value by 20-30%.