Conventional wisdom suggests that conditions in the broader economy significantly influence M&A activity.

So, the recent drop in equity prices is now leading some economists to predict a recession, and a tightening monetary policy is driving interest rates up. Add to those issues the uncertainty of a snarled global supply chain and an ongoing conflict in Ukraine – and you wouldn’t be surprised to see buyers adopting a more cautious approach to acquiring companies.

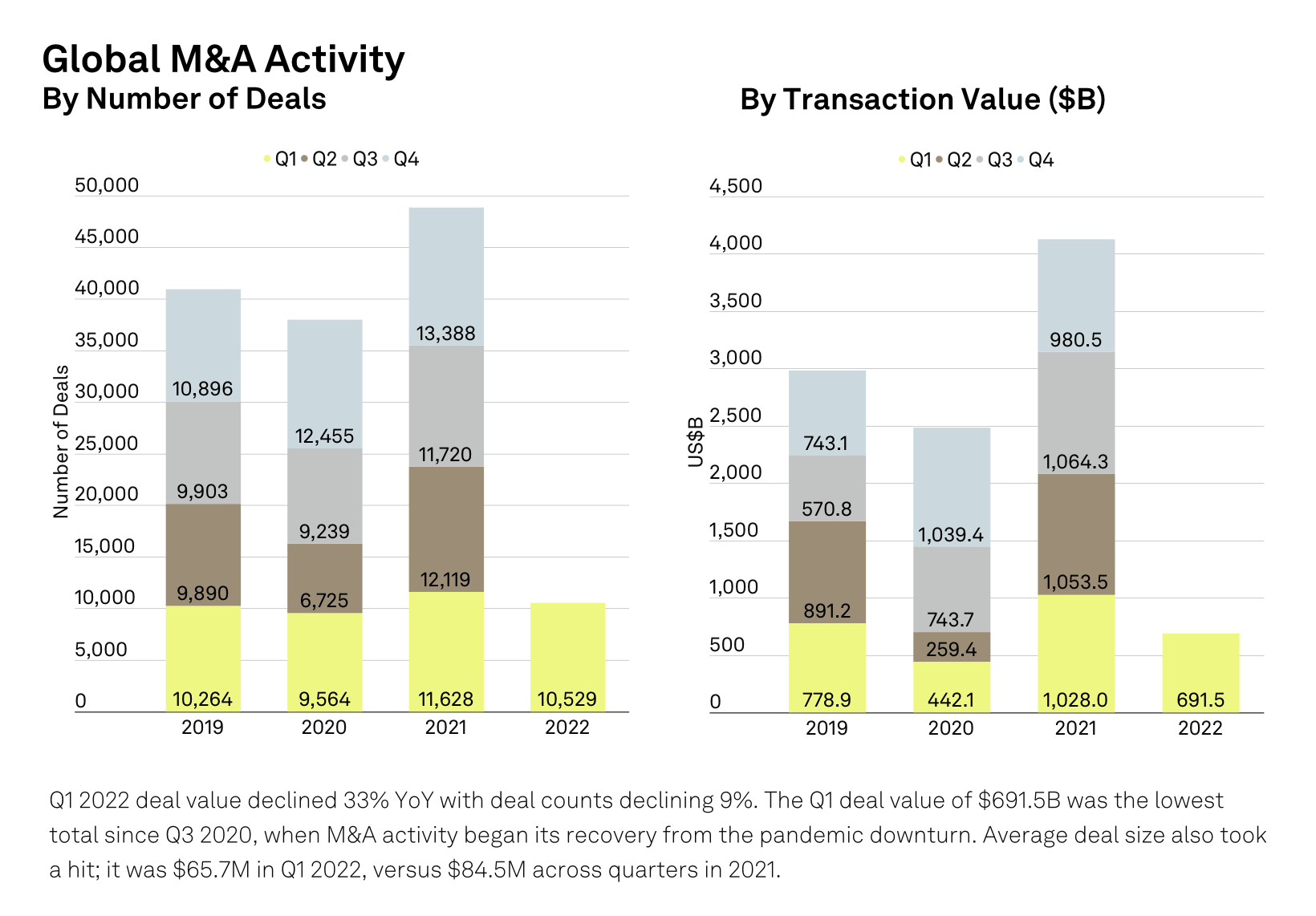

And indeed, that’s exactly what we see when we look at global M&A activity for the first quarter of 2022. S&P Global reports 1Q2022 deal volume was off by almost 33%, and deal counts were down 9% compared to the same quarter last year. For North America, deal value in the first quarter was down almost 24%.

Source: S&P GLOBAL

Those statistics are not surprising.

What might be surprising is that the lower middle market, which is the market segment dominated by privately held companies, appears to be bucking these trends. Specifically, valuations and overall activity appear to be unchanged by the current economic uncertainty – at least for now.

We think there are at least three reasons the market remains strong for selling private companies:

- Mega-deals between public companies dominate the global M&A stats, but the market for privately-owned companies is always different. Most importantly, private companies are typically sold to different kinds of buyers – like other private companies, private equity firms, or even individual buyers. So while global M&A is an interesting measure of overall activity, it isn’t relevant for most sellers.

- Despite some economic risks, many business leaders remain optimistic about the future. And some argue that private businesses will be less affected by global economic conditions than large public companies. Regardless, private companies that are strong, profitable, and growing are always attractive to buyers, regardless of the broader economic conditions.

- Interest rates are up but are still historically low, and capital for acquisitions is still readily available. During the credit crunch of 2008, we saw many buyers that were previously only interested in “larger” acquisitions pursue private sellers in the lower middle market, and we think those conditions might repeat in the next few years.

Eventually, rising interest rates might negatively impact private company valuations, and higher capital gains could take a larger bite out of your sale proceeds. But for now, the market is good – especially if your sales are growing.

So if you’re thinking about selling, we’d love to tell you about our process for maximizing value. Alternatively, if you’re not sure if your company is valuable enough to support your retirement goals, we gladly help.

Please contact us.