Chances are, if you’re a business owner nearing retirement, you’ve been waiting for the right time to sell.

If that’s you, we have good news: the post-pandemic market for privately-held businesses has officially recovered.

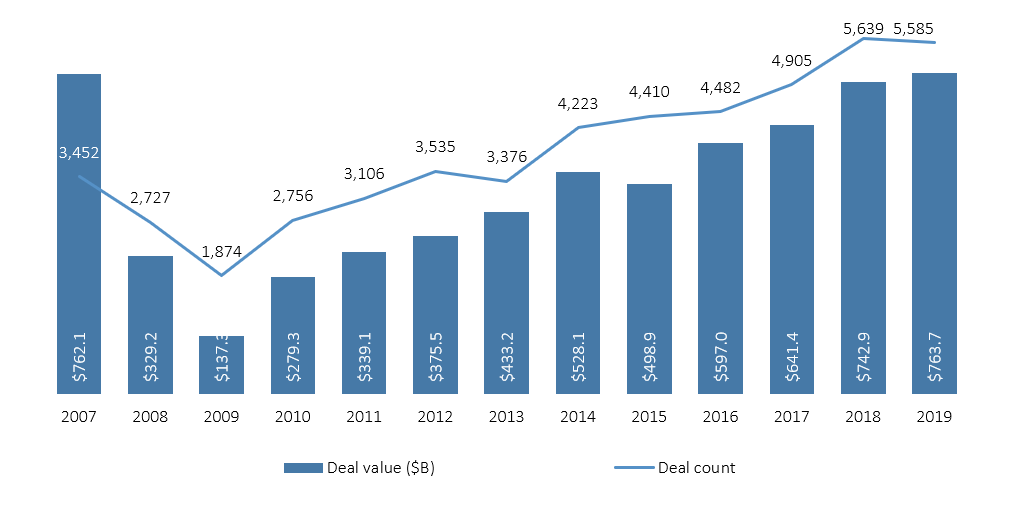

One of the best measures of the market’s health is acquisition activity by Private Equity (PE) firms. PE firms are popular buyers of private companies, so strong PE activity is a good sign for many business owners.

PE activity peaked in 2007 but dropped off significantly as the economy stalled following the sub-prime mortgage crisis. But the market grew steadily from 2009 through 2019.

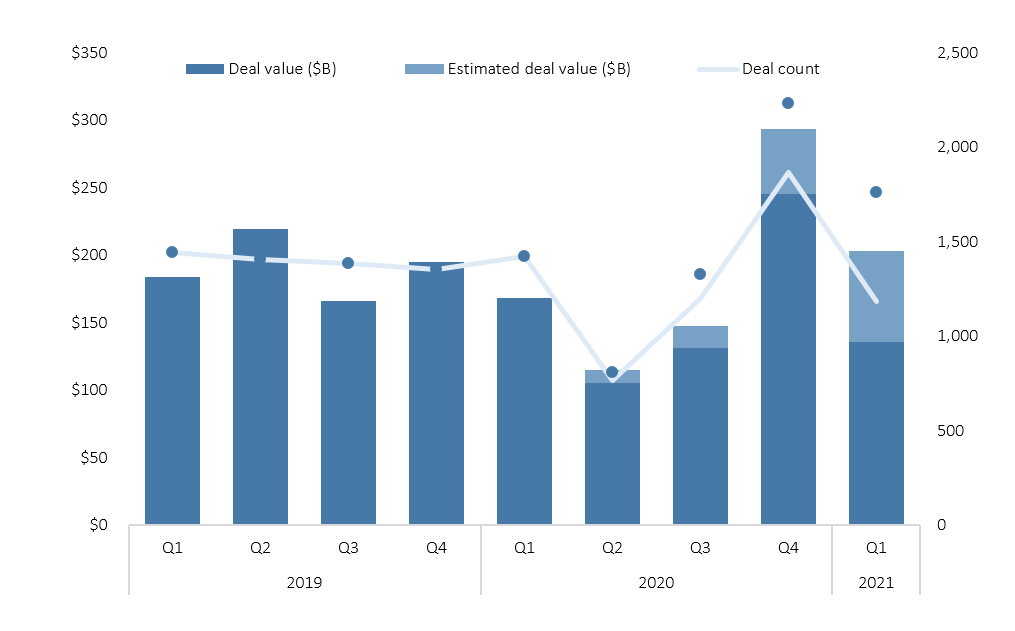

The market was disrupted again in 2020 when the pandemic set in changed the economy. Activity in 2Q2020 was more than 50% lower than the comparable quarter in 2019, and activity in 3Q2020 was down by 20%.

But the market recovered in 4Q2020 and has stabilized in 1Q2021 due to unprecedented stimulus, low interest rates, and pent-up demand for solid companies. Transaction activity in the first quarter of this year was 20% higher than 2020 and more than 10% higher than 2019, as shown in the following chart.

The data shown above reflects a clear recovery across all US PE transactions. If you’ve been waiting for strong market conditions, your wait may be over.

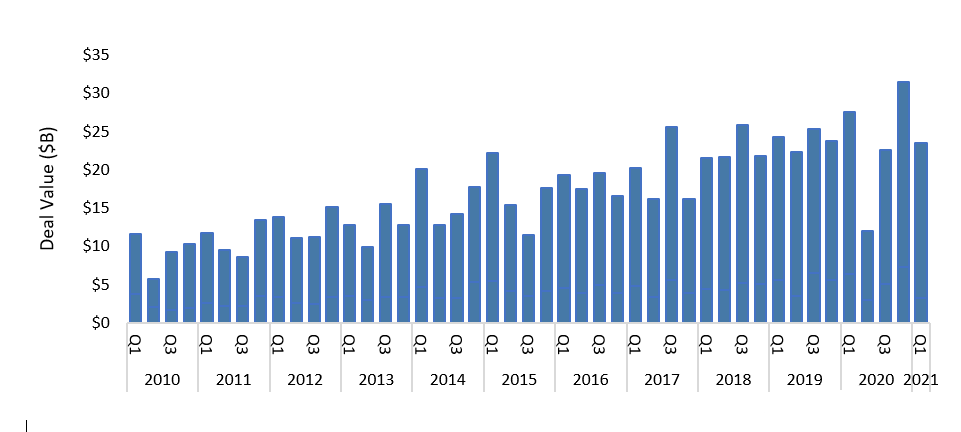

You may be wondering if the demand for companies like yours is similarly strong. Although there is some variation by industry, the last data shows a return to pre-pandemic market conditions for many of ASG’s clients, whose revenues are usually between $3 and $100 million. The following chart shows strong recovery in this segment, where buyers include private or public companies or even individuals, in addition to PE firms.

So, if you’ve been thinking about selling but have been waiting for the post-pandemic market recovery, this might be a good time to have your company valued. Demand is strong, capital is available, and valuable multiples are attractive. Moreover, proposed tax increases might make 2021 a more attractive time to sell than 2022 and beyond.

Please contact us, and we’ll gladly connect you to an ASG Principal who can answer many of your market questions over the phone.

Additionally, if PE firms or other buyers have expressed interest in buying your company, please contact us. We’ll offer some free advice about how to protect your confidentiality, maximize value, and increase the likelihood of success.

* All data provided by Pitchbook